Vanilla is one of the world's most expensive spices, second only to saffron. While labor-intensive cultivation and hand-pollination contribute to the cost, one of the most significant factors driving vanilla prices skyward is something growers cannot control: natural disasters. When hurricanes, typhoons, and cyclones strike vanilla-growing regions, the impact reverberates through global markets for years.

Why Vanilla Takes Years to Recover

Understanding vanilla's vulnerability to natural disasters requires understanding the plant's growth cycle. Vanilla orchids are perennial vines that require 3-4 years of careful cultivation before they produce their first harvestable beans. Even then, young vines don't reach peak production until they're 5-7 years old.

When a hurricane or typhoon devastates a vanilla-growing region, it doesn't just destroy the current year's crop—it destroys years of investment and sets back production for half a decade or more. Mature vines are uprooted, trellises are demolished, and the infrastructure needed for curing and processing is damaged or destroyed.

The recovery timeline is brutal:

- Year 0 (disaster year): Complete crop loss, infrastructure damage

- Years 1-2: Replanting, rebuilding, no production

- Years 3-4: First beans appear, but yields are minimal

- Years 5-6: Production gradually returns to pre-disaster levels

This 4-5 year recovery period creates supply shocks that ripple through the global vanilla market, driving prices to extraordinary heights and keeping them elevated for years.

The Global Impact: When Supply Meets Demand

Vanilla demand is relatively inelastic—food manufacturers, flavor houses, and consumers continue to need vanilla regardless of price. When a major producing region like Madagascar (which supplies 80% of global vanilla) is hit by a cyclone, the sudden supply contraction meets unchanged demand, and prices skyrocket.

The 2017 example is instructive: Cyclone Enawo struck Madagascar in March 2017, devastating the SAVA vanilla-growing region. Vanilla prices, already elevated, surged to $600 per kilogram—higher than silver by weight. Prices remained elevated for years as the region slowly recovered, only beginning to normalize in 2020-2021.

A History of Hurricanes, Typhoons, and Cyclones in Vanilla Regions (2010-2025)

The following chronology documents major tropical cyclones that have impacted vanilla-growing regions over the past 15 years, illustrating the persistent threat these storms pose to global vanilla supply:

2024

- Cyclone Gamane (March 2024) - Madagascar: Category 4 cyclone struck northeastern Madagascar, affecting vanilla-growing areas with severe flooding and wind damage

- Cyclone Freddy aftermath effects - Madagascar: Continued recovery from 2023 damage

2023

- Cyclone Freddy (February 2023) - Madagascar: One of the longest-lasting tropical cyclones on record, impacting Madagascar's eastern coast with flooding and wind damage

- Cyclone Cheneso (January 2023) - Madagascar: Struck northern Madagascar with heavy rainfall affecting agricultural regions

2022

- Cyclone Batsirai (February 2022) - Madagascar, Mauritius, Réunion: Intense Category 4 cyclone caused widespread damage across Madagascar's eastern coast and affected Mauritius and Réunion

- Cyclone Emnati (February 2022) - Madagascar: Followed Batsirai within days, compounding damage to already-affected regions

- Tropical Cyclone Dovi (February 2022) - Vanuatu: Affected northern Vanuatu vanilla-growing areas

2021

- Cyclone Niran (March 2021) - Vanuatu, New Caledonia: Passed near Vanuatu's vanilla regions before intensifying

- Tropical Cyclone Seroja (April 2021) - East Timor, Indonesia: Caused significant damage in East Timor and eastern Indonesia, affecting vanilla cultivation areas

2020

- Cyclone Harold (April 2020) - Vanuatu, Tonga: Category 5 cyclone devastated Vanuatu's northern islands, major vanilla-growing region, then impacted Tonga

- Tropical Cyclone Uesi (February 2020) - Vanuatu: Affected Vanuatu before moving toward New Caledonia

2019

- Cyclone Idai (March 2019) - Madagascar, Mozambique: While primarily devastating Mozambique, Idai affected Madagascar's western regions

- Cyclone Kenneth (April 2019) - Madagascar, Comoros: Struck northern Madagascar and Comoros with severe impact

2018

- Cyclone Gita (February 2018) - Tonga: Category 4 cyclone caused severe damage across Tonga

- Cyclone Josie (April 2018) - Vanuatu: Impacted Vanuatu's agricultural regions

- Tropical Storm Lane (August 2018) - Hawaii: Brought extreme rainfall to Hawaii's Big Island, affecting Kona vanilla farms

2017

- Cyclone Enawo (March 2017) - Madagascar: Category 4 cyclone, the most devastating storm to hit Madagascar in 13 years, directly struck the SAVA vanilla region, destroying an estimated 30% of the vanilla crop and triggering the historic price spike to $600/kg

- Cyclone Donna (May 2017) - Vanuatu: Category 4 cyclone affected northern Vanuatu vanilla areas

2016

- Cyclone Winston (February 2016) - Fiji, Tonga: Category 5, one of the strongest Southern Hemisphere cyclones on record, devastated Fiji and affected Tonga

- Cyclone Fantala (April 2016) - Madagascar: Extremely intense cyclone passed north of Madagascar, affecting northern regions

2015

- Cyclone Pam (March 2015) - Vanuatu, Tonga: Category 5 cyclone caused catastrophic damage to Vanuatu, one of the worst natural disasters in the nation's history, severely impacting vanilla production

- Cyclone Lam (February 2015) - Australia: Struck Northern Territory, affecting some vanilla cultivation areas

- Tropical Cyclone Marcia (February 2015) - Australia: Category 5 cyclone hit Queensland coast

2014

- Cyclone Ita (April 2014) - Papua New Guinea, Australia: Category 5 cyclone affected PNG's vanilla regions before hitting Australia's Queensland

- Cyclone Ian (January 2014) - Tonga: Category 5 cyclone caused severe damage in Tonga

2013

- Cyclone Haruna (February 2013) - Madagascar: Struck western Madagascar with significant impact

- Cyclone Felleng (January 2013) - Mauritius, Réunion: Passed near Mauritius and Réunion causing damage

2012

- Cyclone Giovanna (February 2012) - Madagascar: Category 4 cyclone struck eastern Madagascar, affecting vanilla-growing regions with severe damage

- Cyclone Irina (February 2012) - Madagascar: Followed Giovanna, compounding damage to Madagascar's east coast

- Cyclone Jasmine (February 2012) - Vanuatu, Tonga: Long-lived cyclone affected multiple Pacific vanilla regions

2011

- Cyclone Bingiza (February 2011) - Madagascar: Struck northeastern Madagascar, directly impacting SAVA vanilla region

- Tropical Cyclone Yasi (February 2011) - Australia: Category 5 cyclone devastated Queensland's coast, one of Australia's most powerful cyclones

2010

- Cyclone Tomas (March 2010) - Fiji, Tonga: Category 4 cyclone caused significant damage across Fiji and Tonga

- Cyclone Ului (March 2010) - Australia: Category 3 cyclone struck Queensland coast

- Cyclone Hubert (March 2010) - Madagascar: Affected Madagascar's northern regions

The Price Impact: Connecting Storms to Market Volatility

The correlation between major cyclones and vanilla price spikes is clear:

2011-2012: Cyclones Bingiza, Giovanna, and Irina struck Madagascar in succession. Vanilla prices began climbing to double their price from 2011 to 2013.

2015-2017: Cyclone Pam devastated Vanuatu (2015), followed by Cyclone Enawo's direct hit on Madagascar's SAVA region (2017). Prices exploded from $100/kg to $600/kg, the highest in vanilla history.

2020-2022: Cyclone Harold hit Vanuatu (2020), followed by Batsirai and Emnati striking Madagascar (2022). While prices had moderated from 2017 peaks, these storms prevented prices from falling further and contributed to continued market volatility.

2023-2024: Cyclones Freddy, Cheneso, and Gamane continued the pattern of regular storm impacts on Madagascar, maintaining supply uncertainty and price pressure.

Beyond Madagascar: Diversification Challenges

While Madagascar dominates global vanilla production, the historical record shows that virtually every vanilla-growing region faces cyclone risk. The Pacific islands (Vanuatu, Tonga, Fiji), Indian Ocean islands (Réunion, Mauritius, Comoros), Indonesia, Papua New Guinea, and even Hawaii all sit in cyclone-prone zones.

This geographic reality means that diversifying vanilla sourcing—while important for risk management—cannot eliminate weather-related supply shocks. The tropical climate that vanilla requires is inherently cyclone-prone.

Climate Change and Future Outlook

Climate scientists project that while the total number of tropical cyclones may not increase significantly, the proportion of intense Category 4 and 5 storms is likely to rise. Warmer ocean temperatures provide more energy for storm intensification, potentially making future cyclones even more destructive to vanilla-growing regions.

This trend suggests that vanilla price volatility driven by natural disasters may become more pronounced in coming decades, not less.

Why Vanilla Remains Expensive

The persistent threat of hurricanes and typhoons is a fundamental factor in vanilla's high cost. The combination of:

- Multi-year cultivation cycles requiring sustained investment

- 4-5 year recovery periods after disasters

- Concentration of production in cyclone-prone tropical regions

- Inelastic global demand

- Increasing storm intensity due to climate change

...creates a market characterized by supply uncertainty and price volatility. When you purchase vanilla beans, you're not just paying for the labor of hand-pollination and careful curing—you're paying for the risk that the next cyclone season could wipe out years of work in a matter of hours.

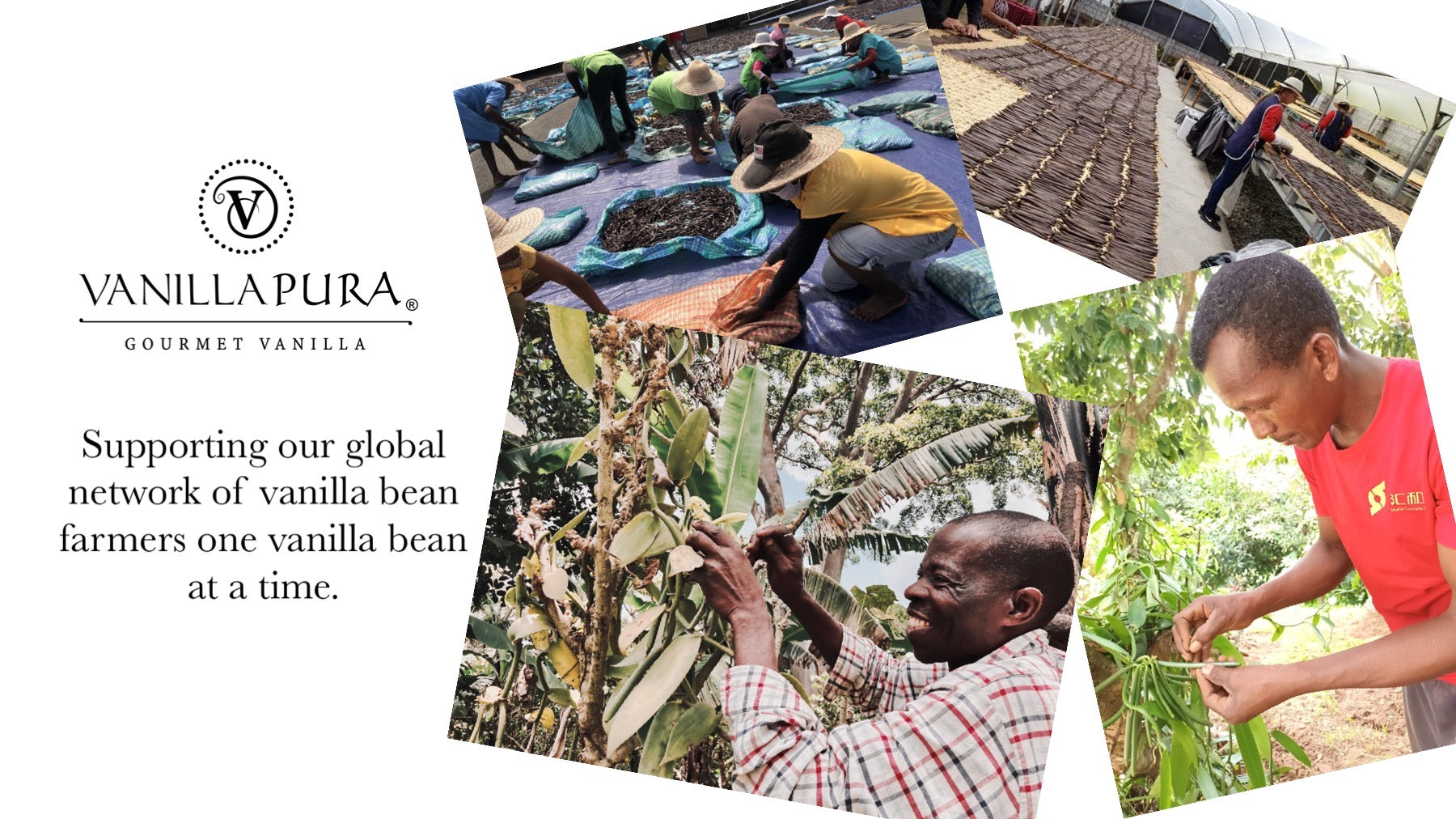

The Human Cost

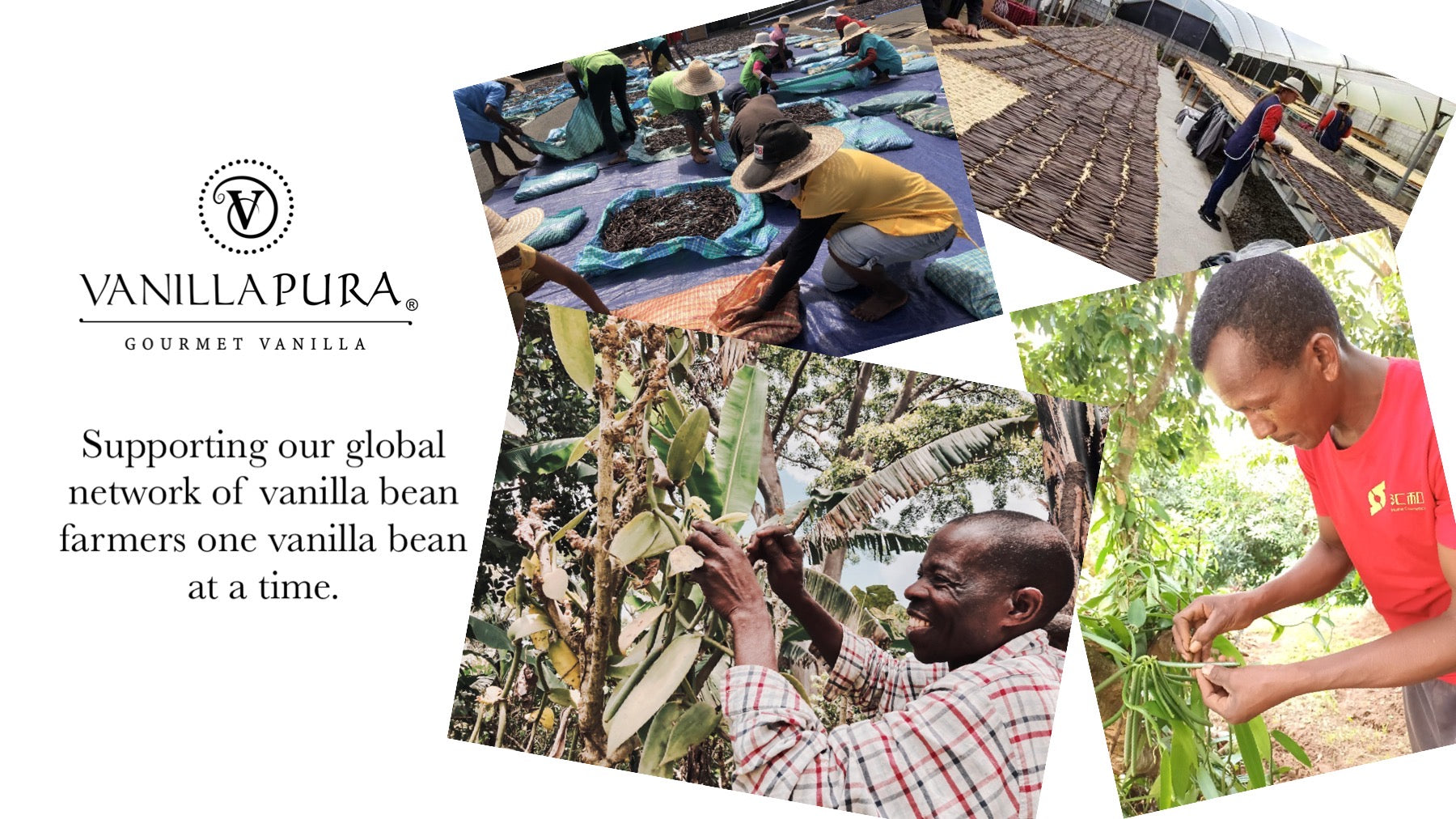

Behind every price spike is a human story. Vanilla farmers in Madagascar, Vanuatu, and other regions face not just economic loss but personal devastation when cyclones strike. Homes are destroyed, communities are displaced, and livelihoods built over generations can vanish overnight.

The years-long recovery period isn't just about replanting vines—it's about rebuilding lives, communities, and hope. When vanilla prices spike, it reflects not just market dynamics but the resilience of farmers who, time and again, replant their fields and begin the long journey back to productivity.

Understanding the True Cost of Vanilla

The next time vanilla prices seem high, remember the history documented here: a relentless pattern of natural disasters striking the world's vanilla regions, each one setting back production for years and creating supply shocks that reverberate globally.

Vanilla's expense isn't arbitrary—it's the market's reflection of genuine scarcity, climate vulnerability, and the extraordinary resilience required to cultivate this remarkable spice in some of the world's most storm-prone regions. Every vanilla bean represents not just months of careful cultivation, but years of risk, recovery, and unwavering commitment from farmers who face nature's fury and keep planting.